Wills, Probate and Estate Planning

WT has experienced professional members in providing services for wills, probate and estate planning matters. We may provide our professional services in various ways including the following:-

- Wills drafting;

- Review of existing will and provide for advice on validity;

- Miscellaneous applications to the Probate Registry and/or further assistance in relation to the deceased person’s estate (e.g. grant of Probate or Letters of Administration, distribution of the assets).

- Estate planning service for high-net-worth individual clients by way of legal schemes such as trust or offshore company followed by proper advice on tax issues or efficient distribution of assets covering following aspects:-

(i) control over your estate;

(ii) proper provision for ideal beneficiaries of your assets such as minor children;

(iii) support good causes of the beneficiaries;

(iv) administration of multi jurisdictional assets portfolio.

Do you know about the Will in Hong Kong?

Some people may be reluctant to talk about the Will to distribute their assets after they die. But to prepare the effective Will is important not only for avoiding unnecessary trouble in respect of the distribution of assts but also for completing probate in smoother and cheaper way. unnecessary trouble in respect of the distribution of assts but also for completing probate in smoother and cheaper way.

However, as the homemade will often leads to disaster, to have the Will drafted by professional lawyer in effective way is essential. For example, you should normally appoint person(s) to administer your assets who is/are called “executor(s)”in your will but there are some restrictions in relation to executor(s). One of the restrictions is the appointment of minority as a sole executor. As the age restriction for beneficiary under the will is over 18 years old, is it now allowed to appoint your minor child as a sole executor in the will in contemplation of your death in the future? Yes, it is possible. The law allows you to appoint your minor child as a sole executor but he/she cannot obtain the necessary authority to administer the assets which is called “probate” until he/she attains the age of 21 years old.

WT may assist you in drafting your tailor-made Will flexibly depending on your requests and may also interpret the validity of existing wills.

Do you know about the probate in Hong Kong?

What is initial step to distribute the assets of the deceased?

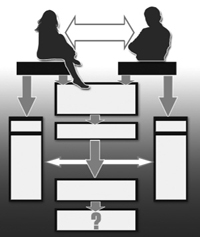

In order to distribute the assets of the deceased, the relevant approval must be granted by the court to personal representative(s) who may be entitled and wish to administer the assets of the deceased.

What we must take care is that the procedures and the person(s) with whom such approval is granted vary depending on the case. What we must take care is that the procedures and the person(s) with whom such approval is granted vary depending on the case.

If the deceased leaves the will which appoints person(s) to administer his/her assets, then such peson(s) shall be referred to as “executor(s)”and he/she shall apply for a court order described as “Probate”.

If the deceased does not leaves the will, a court order shall be granted to person(s) who shall be referred to as “administrator(s)”and a court order described as “Letters of Administration” shall be granted to the administrator(s).

Besides the usual cases above, there are some other situations where the Letters of Administration (with will annexed) shall be granted to proper administrator(s). Such a situation occurs, for example, there is a will but it did not appoint executor, appointed executor(s) died or renounced his/her entitlement or appointed person is not proper for executor.

Depending on the situation, the procedure, the necessary documents or the relevant formats to be filled in for obtaining the court’s approval will be different. WT will assist your Probate matters flexibly depending on the situation.

Do you know about the Estate Planning in Hong Kong?

After you accumulate your assets in Hong Kong or everywhere, then it will be natural for you to think how to manage your assets efficiently or leave those assets to those whom you wish.

There are many unique schemes in Hong Kong to manage your various types of assets efficiently.

One simple example is that now you are planning to pass your residential property to your spouse but you assume that he/she may transfer the same property to your son later and you son may transfer the same property to other relatives…

In Hong Kong, the Stamp Duty for transfer of real property is considerable amount payable in progressive way depending on the value of the property transferred, therefore you may worry about the multiple payments of Stamp Duty for each transfer of the residential property.

However, as you may incorporate a limited company very easily from capital of HK$1 in Hong Kong, you may consider to set up a paper company then to transfer the residential property to the company first thereby paying the usual amount of Stamp Duty. Thereafter, in the future, the parties may always transfer the share(s) of the company which owns the property instead of transferring the property itself. Total amount of Stamp Duty payable for transfer of share(s) is fixed duty of HK$5 plus ad valorem duty at the rate of 0.2% of the total share price OR Net Asset Value of the shares. If the value of the property exceeds a certain amount, you may save a substantial amount of Stamp Duty in this way by comparing with the amount of Stamp Duty payable for transfer of residential property. transfer the residential property to the company first thereby paying the usual amount of Stamp Duty. Thereafter, in the future, the parties may always transfer the share(s) of the company which owns the property instead of transferring the property itself. Total amount of Stamp Duty payable for transfer of share(s) is fixed duty of HK$5 plus ad valorem duty at the rate of 0.2% of the total share price OR Net Asset Value of the shares. If the value of the property exceeds a certain amount, you may save a substantial amount of Stamp Duty in this way by comparing with the amount of Stamp Duty payable for transfer of residential property.

One more point to note to the example above is that if you incorporate a paper limited company in British Virgin Islands (BVI), then you may even save the Stamp Duty for transfer of share(s). No Stamp Duty is payable where the BVI company share(s) is/are transferred in Hong Kong (but please be careful if the register of members of the BVI company is kept in Hong Kong, the company is deemed as a Hong Kong company and the Stamp Duty is still payable).

WT may propose the various schemes to manage your important assets depending on your ideal plans.

*Legal information above is only rough explanation for general circumstances and does not constitute any legal opinion for any particular situation. Therefore, please do not apply the information above to any particular case directly and always seek for professional legal opinion in your case.

|